Digitise policyholder & distributor KYC/KYB, PEP/sanctions, adverse media check.

Development supported by Enterprise Estonia (EIS) and the Estonian Ministry of Economic Affairs and Communications:

Project duration: 02.12.2024 – 30.11.2025

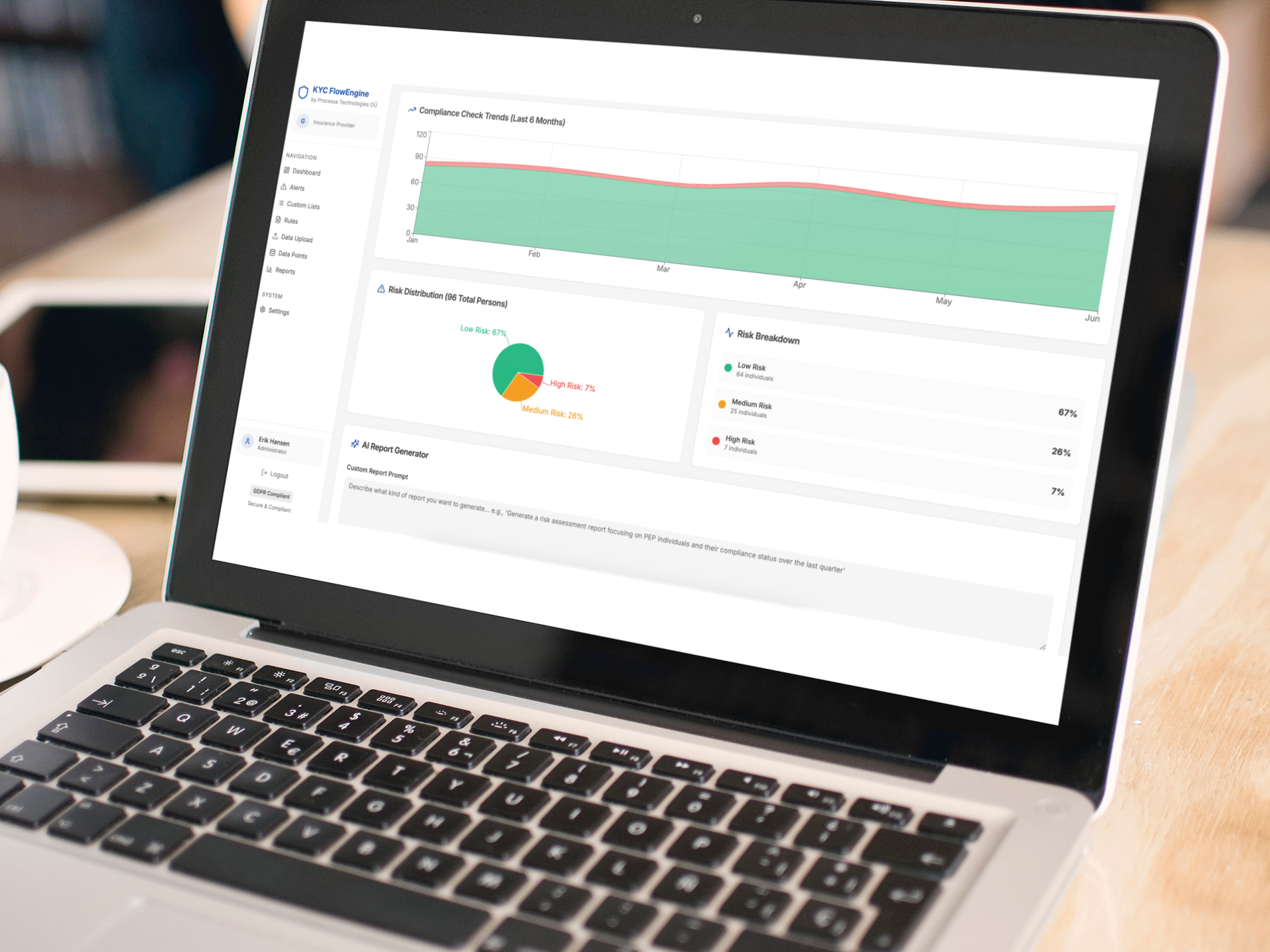

Project overview: Pilot the KYC FlowEngine platform to help insurers automate onboarding, reduce manual tasks, improve data accuracy, and ensure seamless compliance.

Project support: 63 996,27€

Connect insurance core, portals (customer/ broker/ agent), and data providers + X‑tee (X‑Road) data exchange via one agentic layer to reduce handoffs and re‑keying.

Prefill from IDs & registries, auto-collect missing docs, and provide instant risk-aware decisions.

Agentic checks surface inconsistencies and risky relationships; standardised decisions improve governance.

Streamline complex KYC workflows — from data collection to risk scoring—with real-time rule-based decisioning

Automates risk assessments and enables machine-readable data processing for real-time verification and monitoring—purpose-built for insurers, brokers, and agents.

Multi-LLM routing (GPT / Croc / Claude / Llama) with policy-based controls and PII safeguards.

Connect core systems, CRM, case tools and data providers—no more swivel-chair ops.

Multi-agent flows coordinate screening, scoring, outreach and filings.

Configure TM & case triggers in plain language, iterate without redeploys.

Task‑aware model selection across chatGPT, Croc, Claude, Llama.

Policies, evaluators, approvals and immutable audit logs.

SSO, RBAC, SCIM, least‑privilege service accounts.

Tokenization, encryption, IP allow‑lists and secrets management.

Low‑code delivery for faster TTV with versioning & testability.

Processa Technologies is Siemens Mendix certified partner in the Baltics since 2021.

Mendix is a low-code development platform for creating business transformation solutions.